Money Laundering Offence In Germany

The concept of money laundering is essential to be understood for these working in the monetary sector. It is a process by which soiled money is converted into clean money. The sources of the cash in precise are criminal and the money is invested in a way that makes it appear to be clear money and hide the id of the criminal part of the cash earned.

While executing the monetary transactions and establishing relationship with the new clients or sustaining existing clients the responsibility of adopting enough measures lie on every one who is a part of the organization. The identification of such element to start with is simple to cope with as a substitute realizing and encountering such situations afterward within the transaction stage. The central financial institution in any country supplies full guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously provide sufficient security to the banks to deter such conditions.

While the general punishment for money laundering is up to five years of imprisonment with minimum term an intentional offense by an obliged person under the GWG carries a minimum sanction of 3 months. This means that anyone who smuggles illegally obtained assets into the legal economy will be.

Money Laundering And Terrorist Financing Awareness Handbook For Tax Examiners And Tax Auditors Oecd

As a result on 18 March 2021 the German government introduced the new section 261 of the Criminal Code StGB the offence of money laundering.

Money laundering offence in germany. Whether the offence was committed on German territory is defined by section 9. Criminal money laundering pursuant to Section 261 of the German Criminal Code StGB comprises the following elements. If the offence was committed in Germany the Criminal Code applies section 3.

B in the other cases under section 218 if the offender is a German national at the time of the offence whose livelihood is based in Germany. While the general punishment for money laundering is up to five years of imprisonment with minimum term an intentional offense by an obliged person under the GWG carries a. The German parliament Bundestag has passed a new version of the money laundering offence which has far-reaching implications for the fulfillment of obligations under the Money Laundering Act.

1 The German Financial Intelligence Unit may request that the Financial Intelligence Units of other countries which deal with the prevention detection and combating of money laundering predicate offences for money laundering and terrorist financing provide information including personal data or the transmission of documents if this information and these documents are necessary for the. Germany is seen as a money laundering paradise. Prosecuting money laundering will become considerably easier in Germany.

1 and 4 sentence 1 if the offender is a German national at the time of the offence and. At the same time it has implemented an EU directive into national law more stringently than required by the EU. The newly formulated money laundering offence Section 261 of the German Criminal Code will expand the basis of criminal activity that underpins money laundering all-crimes approach.

How can Money Laundering be Proved. Up until now money laundering was only a criminal offense in Germany if the assets stem from certain criminal offenses such as human or drug trafficking. In Germany today money laundering is above all an offence of organised crime.

1 money or other assets are the proceeds of an offence. A in the cases under section 218 2 sentence 2 no. The money in question must be the result of a criminal offence.

The study commissioned by the Finance Ministry in Berlin said over 100 billion euros in money-laundering. And 3 the offender is aware that the assets are the proceeds of an offence. Whether the offence was committed on German territory is defined by section 9.

Only serious crimes criminal commercial fraud but not for example simple tax evasion corruption offences insider trading etc can infect funds. It can be difficult to establish where the money originated from and it can be challenging to show that the offender did commit a criminal offenceThe act of money laundering is legislated for under 261 German Criminal Code StgB and it outlines the following. Following the reform concealing criminal profits is now definitely a criminal offense.

The country also appears to be a magnet for criminals from further afield. Offences against physical integrity. 2 the proceeds were intentionally concealed disguised procured for himself or a third party used for himself or a third party by the offender or their origin or tracing or confiscation was thwarted or endangered by the offender.

If the offence was committed in Germany the Criminal Code applies section 3. On February 11 2021 the Bundestag passed the Act to Improve Criminal Law.

Anti Money Laundering 2021 Germany Iclg

Pemetaan Kejahatan Transnasional Money Laundering Di Indonesia Fix

1 Dymimic Estimation Of The Amount Of Money Laundering For 20 Highly Download Scientific Diagram

European Union Money Laundering Directives Overview Cams Afroza

The Concept Of Money Laundering Download Scientific Diagram

6amld A New Anti Money Laundering Regulation

Https Intercostos Org Wp Content Uploads 2018 01 Friedrich Pdf

Council Of Europe Treaties Against Money Laundering

Germany A Safe Haven For Money Laundering Germany News And In Depth Reporting From Berlin And Beyond Dw 30 10 2012

6amld A New Anti Money Laundering Regulation

Pdf Evaluating The Control Of Money Laundering And Its Underlying Offences The Search For Meaningful Data

Corruption And Money Laundering The Nexus Way Forward

Money Laundering In Germany Stringent New Rules For Companies

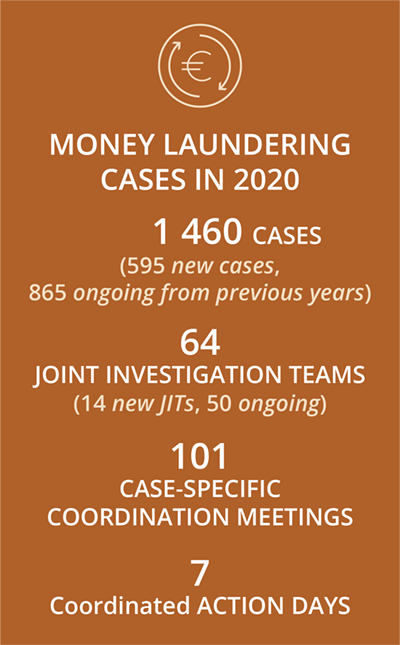

7 3 2 Money Laundering Eurojust European Union Agency For Criminal Justice Cooperation

The world of regulations can seem to be a bowl of alphabet soup at times. US money laundering regulations aren't any exception. Now we have compiled an inventory of the highest ten cash laundering acronyms and their definitions. TMP Threat is consulting firm focused on defending financial companies by reducing risk, fraud and losses. We now have large financial institution experience in operational and regulatory danger. We now have a strong background in program administration, regulatory and operational danger in addition to Lean Six Sigma and Enterprise Process Outsourcing.

Thus cash laundering brings many adversarial consequences to the group due to the risks it presents. It increases the chance of major dangers and the chance cost of the financial institution and ultimately causes the bank to face losses.

Comments

Post a Comment